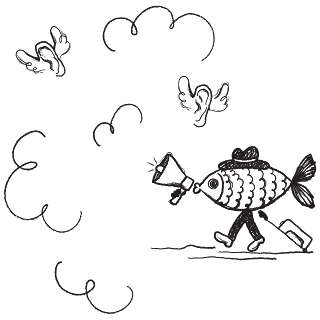

About Ughhrrumph

Ughhrrumph is an onomatopoeia for the frustration I felt working in the job that I hated, with a boss that didn't understand my job, yet liked to micromanage (I was a low-level data analyst at the time). It was the exact feeling that got me dreaming about escaping the rat-race, and the feeling that helped me realise the importance of reaching financial independence, and retiring early ( FIRE ). I left that job years ago, but I haven't forgotten how it felt. I owe a lot to that feeling of frustration, and I don't want to forget it. Frustration isn't usually looked upon with fondness, but if I'm honest, I do a lot of my best work when I'm frustrated. For example, I made my own FIRE calculator because I was frustrated with the complexity of picking the best strategy to reach FIRE. It helped me so much to come to peace with my plan, I started this blog as a vehicle for sharing the calculator hoping it might also help others. I assume there will be more f